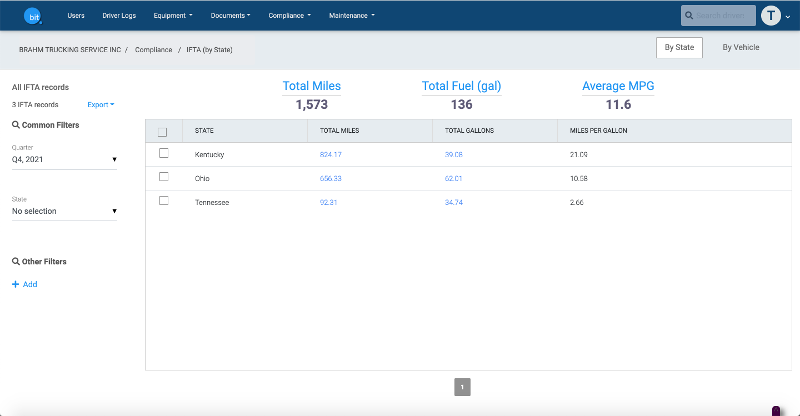

BIT IFTA

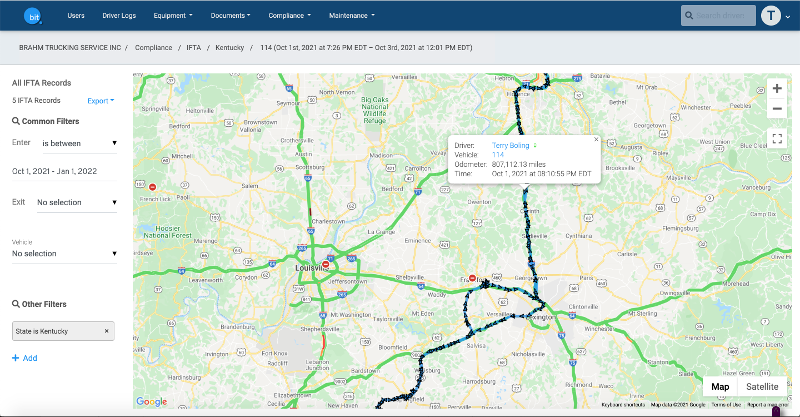

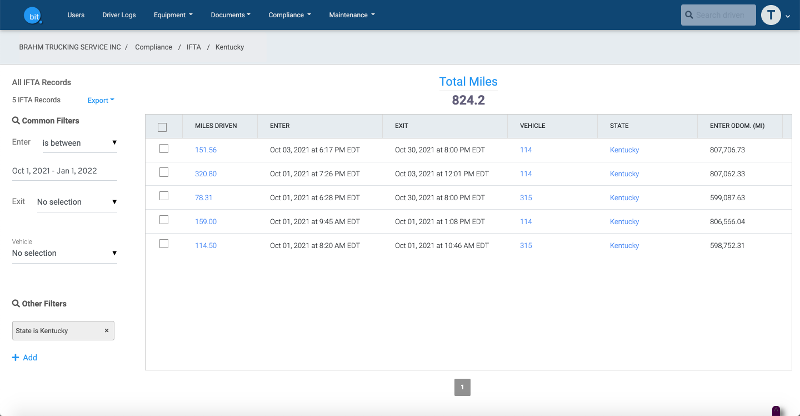

Get in-state miles with a click

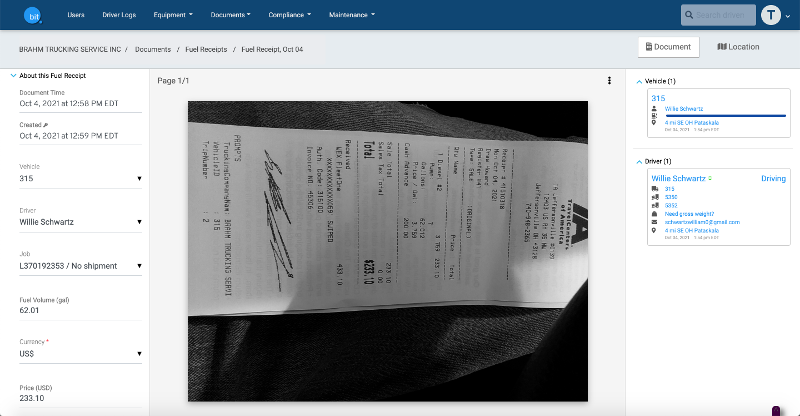

Nobody wants to spend hours every quarter tracking down drivers in-state mileage and fuel receipts. With the BIT App and the BIT ELD drivers can:

Take the pain out of your quarterly fuel tax reports.

*BIT IFTA does not calculate state tax rates

Still have questions? Check out our FAQ page or send us your questions